Getting My Summitpath Llp To Work

Getting My Summitpath Llp To Work

Blog Article

Examine This Report about Summitpath Llp

Table of ContentsThe Summitpath Llp DiariesSummitpath Llp Things To Know Before You Get ThisA Biased View of Summitpath LlpThe smart Trick of Summitpath Llp That Nobody is DiscussingSome Known Factual Statements About Summitpath Llp

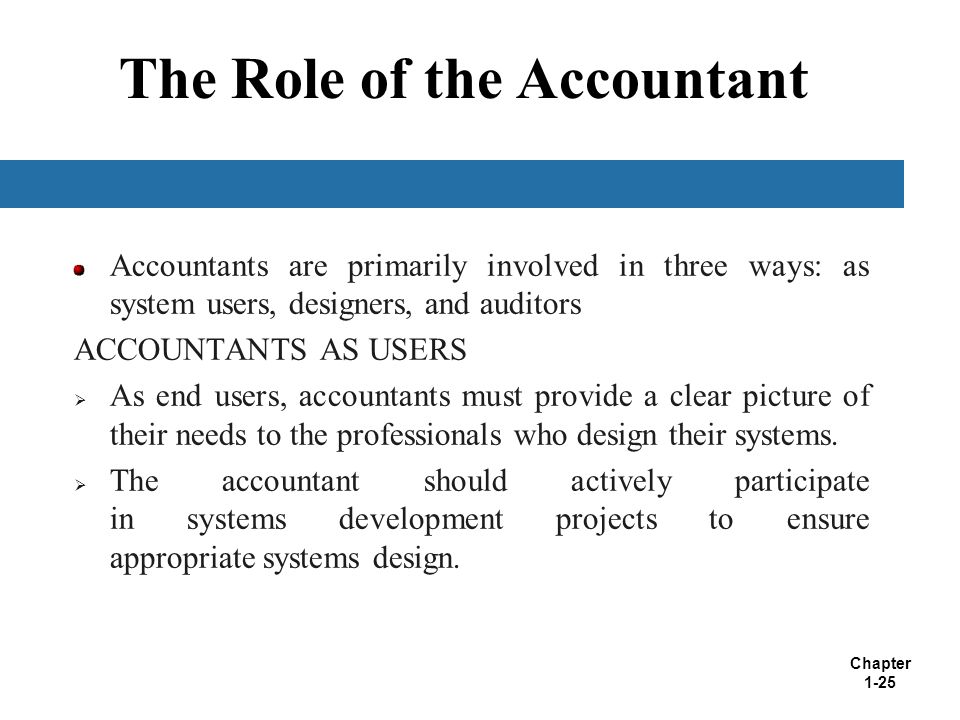

A monitoring accountant is an essential function within a business, but what is the function and what are they expected to do in it? ICAEW digs deeper in this administration accounting professional overview. https://www.startus.cc/company/summitpath-llp. A management accounting professional is a crucial role in any kind of organisation. Functioning in the accountancy or money department, monitoring accountants are in charge of the prep work of management accounts and numerous other records whilst also looking after general accounting treatments and techniques within business.Assembling techniques that will certainly lower business expenses. Acquiring money for projects. Recommending on the monetary effects of business decisions. Establishing and supervising monetary systems and treatments and recognizing possibilities to improve these. Controlling income and expenditure within business and making certain that expense is inline with spending plans. Supervising accountancy professionals and assistance with common book-keeping jobs.

Analysing and handling risk within the company. Management accountants play a very vital duty within an organisation. Secret monetary data and reports created by management accountants are utilized by elderly administration to make enlightened service choices. The evaluation of company efficiency is an important role in a management accounting professional's job, this evaluation is created by considering present financial information and additionally non - economic information to identify the setting of business.

Any kind of company organisation with an economic department will certainly require an administration accounting professional, they are also often utilized by economic organizations. With experience, a management accountant can anticipate solid job progression. Specialists with the required credentials and experience can go on to come to be economic controllers, finance supervisors or primary financial policemans.

6 Easy Facts About Summitpath Llp Described

Can see, review and advise on alternate resources of organization money and various means of elevating money. Communicates and suggests what effect monetary decision making is having on developments in law, values and administration. Assesses and recommends on the best strategies to take care of service and organisational efficiency in relation to service and money danger while interacting the impact effectively.

Uses numerous ingenious techniques to execute method and manage adjustment - Bookkeeper Calgary. The distinction in between both financial accounting and managerial audit issues the desired individuals of information. Supervisory accounting professionals need service acumen and their objective is to work as company partners, helping service leaders to make better-informed decisions, while economic accountants intend to create monetary records to provide to external parties

Getting The Summitpath Llp To Work

An understanding of business is also important for management accountants, in addition to the capability to connect successfully in any way degrees to encourage and communicate with senior members of personnel. The duties of a management accountant should be performed with a high degree of organisational and tactical reasoning skills. The average wage for a chartered management accounting professional in the UK is 51,229, a rise from a 40,000 typical gained by management accountants without a chartership.

Providing mentorship and leadership to junior accounting professionals, fostering a culture of cooperation, development, and operational excellence. Teaming up with cross-functional groups to develop budget plans, projections, and long-term monetary methods.

Generous paid time off (PTO) and company-observed holidays. Professional advancement possibilities, including reimbursement for CPA accreditation prices. Flexible work options, including hybrid and remote routines. Accessibility to health cares and staff member assistance resources. To apply, please submit your resume and a cover letter outlining your certifications and passion in the elderly accounting professional duty. Bookkeeper Calgary.

3 Simple Techniques For Summitpath Llp

We're excited to discover a competent elderly accounting professional all set to add to our company's economic success. Human resources get in touch with info] Craft each area of your job summary to show your organization's unique requirements, whether working with an elderly accountant, corporate accounting professional, or one more specialist.

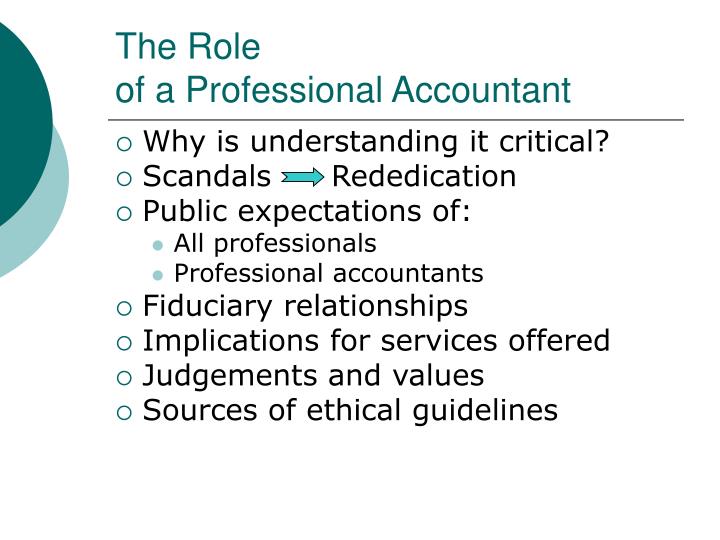

A strong accountant job account goes past noting dutiesit plainly interacts the credentials and assumptions that align with your organization's requirements. Separate in between necessary certifications and nice-to-have skills to aid candidates gauge their suitability for the placement. Define any certifications that are required, such as a CPA (State-licensed Accountant) license or CMA (Licensed Administration Accounting professional) classification.

Summitpath Llp Can Be Fun For Anyone

Comply with these ideal techniques to produce a work description that resonates with the appropriate candidates and highlights the unique aspects of the role. Bookkeeping roles can vary widely depending on standing and field of expertise. Avoid uncertainty by outlining certain jobs and locations of focus. "prepare month-to-month economic declarations and supervise tax obligation filings" is much more clear than "manage financial documents."Mention crucial areas, such as monetary coverage, auditing, or payroll administration, to draw in prospects whose abilities match your requirements.

Use this accountant job description to create a job-winning return to. Accountants help organizations make critical economic decisions and improvements. They do this in a variety of methods, including study, audits, and information input, reporting, evaluation, and monitoring. Accountants can be accountable for tax obligation coverage and declaring, fixing up equilibrium sheets, assisting with departmental and business budget plans, monetary forecasting, communicating findings with stakeholders, and extra.

Report this page